Architecture, engineering, and construction (AEC) companies have the unique opportunity to use R&D tax credits and the Internal Revenue Code (IRC) Section 179D commercial building energy efficient tax deduction.

Specifically, there’s an opportunity to offset capitalization changes with tax legislation that affected R&D tax credits. Learn more about opportunities related to:

R&D Tax Credit

R&D tax credits are dollar-for-dollar tax savings that directly reduce a company’s tax liability. There’s no limitation on the amount of expenses and credit that can be claimed each year. If the federal R&D credit can’t be used immediately or completely, then any unused credit can be carried back one year or carried forward for up to 20 years.

R&D credits are available at the federal and state level, with over 35 states offering a credit to offset state tax liability.

What Does the R&D Tax Credit Apply to?

R&D credit eligibility is much broader than many companies realize, applying not only to product development, but also process improvements. Innovation is key.

AEC companies are making enormous advances in technology for structures and their environments. Companies that continue to push the boundaries by designing or building innovative new structures and subcomponents could find themselves eligible to recoup some of the costs through the R&D tax credit.

What Activities Qualify?

Your organization could be eligible for the R&D tax credit if it:

- Develops new or innovative designs for structures

- Designs and develops new or improved heating, ventilation, air conditioning (HVAC), electrical, lighting, alarm, communication, and control systems

- Develops new or improved processes, prototypes, or software

- Hires designers, engineers, or scientists

- Uses computer modeling and simulations, or the construction of mock-ups for testing

- Designs and develops new and innovative Leadership in Energy and Environmental Design (LEED), energy efficient, or green systems and structures

- Evaluates alternative subcomponents, methods, and materials for use in designs and construction

Changes to R&D Tax Credits from the Tax Cuts and Job Act

The Tax Cuts and Jobs Act (TCJA) made changes to the treatment of Research and Experimentation (R&E) costs, which included a provision that could substantially impact taxpayers who perform R&D.

For tax years beginning after December 31, 2021, taxpayers must capitalize and amortize R&E expenses over the course of either five or 15 years, depending on the location of the underlying activity.

This requirement replaces the longstanding deduction of R&E expenses in the year incurred, provided the taxpayer meets the requirements in Section 174.

Section 179D Tax Deduction

Also known as the Energy Efficient Commercial Buildings Deduction, Section 179D is an incentive to install energy-efficient features in commercial buildings.

For tax years 2022 and prior, Section 179D allows eligible building owners and designers of government buildings a tax deduction of up to $1.80 per square foot3nflation adjusted to $1.88 per square foot for 2022—for work performed on one or more of the following three building systems:

- Interior lighting

- Building envelope

- HVAC and hot water

The Inflation Reduction Act of 2022 dramatically increased the Section 179D energy efficient commercial building deduction, making it especially impactful for the AEC industries.

These changes, which are outlined below, are significant and could add additional value—and complexity—to Section 179D. They apply to qualifying property placed in service after December 31, 2022.

How AEC Firms Could Qualify for Section 179D

AEC companies that create technical specifications for the installation of energy-efficient commercial building property can be classified as designers per the tax code requirements.

To the extent these companies perform work on non-taxpaying entities, the Section 179D deduction associated with the construction project can be allocated to a designer. The eligible non-taxpaying entities available to allocate the Section 179D deduction depends on when the project was placed in service, detailed below.

How Does a Designer Claim the Section 179D Deduction?

An eligible designer claims the Section 179D deduction by applying a Section 179D study in the same tax year as when the building is placed in service. If the building was placed in service during a previous tax year, amending tax returns for years already filed would be required to claim the deduction.

What Is a Section 179D Study?

In a Section 179D study, a qualified third party uses Department of Energy-approved energy software to model the energy performance of the building and improvements.

The energy model then compares the building’s performance with a reference building that meets relevant energy efficiency requirements, according to standards set by the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE).

After completing a physical site visit of the facility and reviewing results of the energy model, the qualified third party verifies that the improvements meet the applicable energy-savings thresholds using the ASHRAE standards. They then sign a certification document for the Section 179D deduction stating they’ve examined the energy model and support the allocation of the deduction to its respective designer.

Note that the third party must be a contractor or professional engineer (PE) licensed in the state where the building is located.

Changes to Section 179D from the Inflation Reduction Act

There are four main opportunities that affect the AEC industries as a result of the Inflation Reduction Act. The act:

- Increases the qualification thresholds

- Adds a bonus deduction

- Expands the deduction allocation to tax-exempt entities

- Creates an alternate deduction path

Increases Qualification Thresholds

To qualify for any deduction, a project must meet a 25% energy cost reduction threshold. The base deduction is equal to 50 cents per square foot with a potential bonus deduction equal to $2.50 per square foot.

The deduction increases on a sliding scale for each percentage point of energy cost reduction above 25% . This increase is capped at a 50% reduction with the base deduction set at $1 per square foot and a potential bonus deduction equal to $5 per square foot. The updated nominal deduction values noted for the base and bonus deduction are all inflation adjusted for tax years 2023 and beyond.

Previously, for projects placed in service in 2022, the tax deduction range was 63 cents per square foot for each of the three eligible systems, including HVAC and hot water, interior lighting, and building envelope to a maximum value as adjusted for inflation of $1.88 per square foot.

Adds Bonus Deduction

The bonus deduction is available to companies that meet local prevailing wage and apprenticeship requirements for any laborers and mechanics employed by the taxpayer or contractors associated with the installation.

The bonus deduction is a new measure introduced by the act and took effect for buildings where construction started after January 30, 2023. If the prevailing wage and apprenticeship requirements are satisfied or construction started prior to this date, taxpayers may be eligible for increased tax deduction amounts.

Expands Deduction Allocation to Tax-Exempt Entities

The deduction can now be allocated to designers of buildings for tax-exempt entities including religious organizations, nonprofit organizations, private K–12 schools, private higher education institutions, and Tribal organizations. This is a significant and beneficial change for the AEC industries as it greatly expands the pool of potentially qualifying properties. Government entities that could previously allocate the deduction will continue to be eligible to allocate.

Creates Alternate Deduction Path

The act creates an alternate deduction path for renovation projects based on reducing a building’s energy-use intensity by 25% or more. This alternate path allows for energy savings to be assessed based on actual energy savings related to the project rather than complying with the typical energy modeling approach.

Using Section 179D to Offset R&D Capitalization Costs

With the new rule changes, R&D costs that formerly could be expensed in the year they were incurred are now spread out over future years. Companies that qualify for Section 179D can use these deductions to help offset the impact of the reduced R&D expense deduction allowable in the current year.

Example

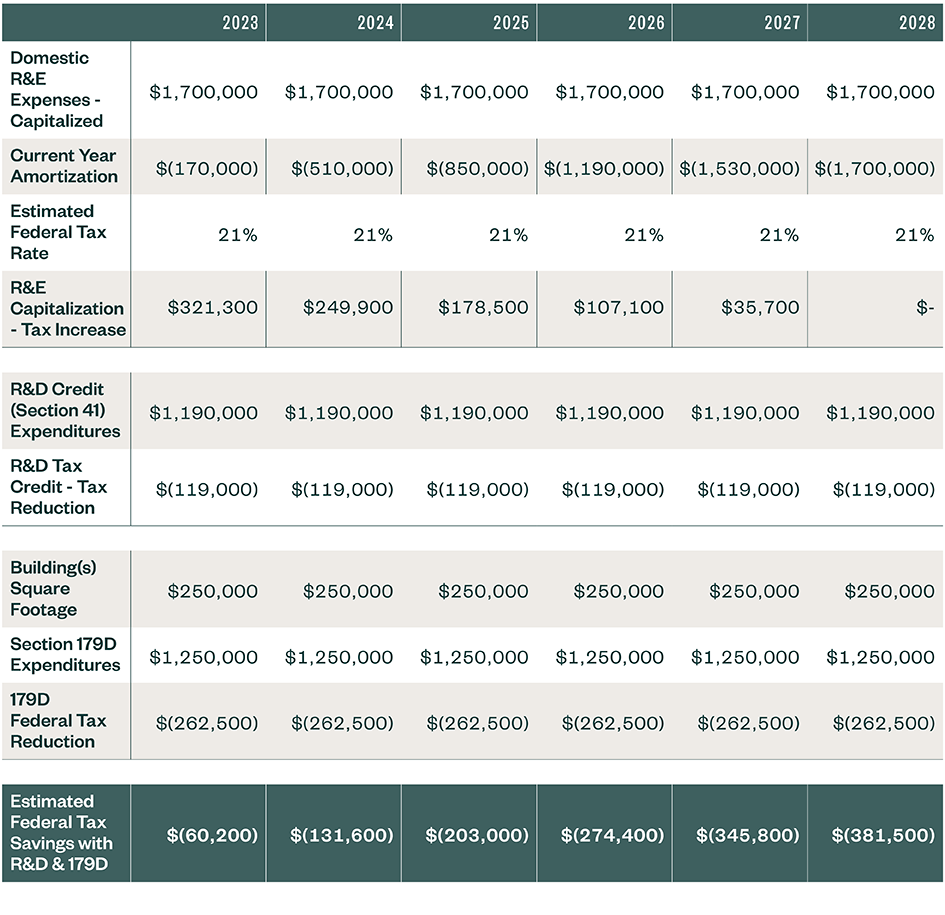

The high-level example included below estimates a taxpayer’s ability to reduce their overall federal tax burden resulting from the required R&E expense capitalization and amortization in tax year 2023 and forward. In 2023, the taxpayer identifies $1.7 million of domestic R&E expenses, which creates an additional $321,300 of tax due in 2023 Assuming the taxpayer is subject to a federal tax rate of 21%

The taxpayer elects to claim a federal R&D credit—Section 41—which in this example generates a $119,000 dollar-for-dollar reduction against the $321,300 of tax.

The taxpayer also determines that 250,000 square feet of buildings also qualifies for the Section 179D tax deduction in 2023 at the maximum deduction rate of $5 per square foot, which further creates a reduction of federal taxes due of $262,500

Therefore, by utilizing both the R&D tax credit and the Section 179D deduction in 2023, the company’s federal tax due is reduced by $60,200, compared to additional taxes due of $321,300. For 2024 through 2028, the tax savings potential becomes even more beneficial due to realizing benefit for prior years’ R&E expense capitalization and amortization.

Potential Congressional Tax Law Changes on the Horizon

On January 16, 2024, leaders in the House Committee on Ways and Means and the Senate Committee on Finance released a bipartisan framework summary, the Tax Relief for American Families and Workers Act, which if passed could make taxpayer friendly changes to the tax strategies outlined above. It includes the delayed application of the requirement to capitalize and amortize domestic R&E expenses until taxable years beginning after December 31, 2025, retroactive to taxpayers beginning after December 31, 2021.

Section 179D Impacts on R&D and R&E Expenses

We’re Here to Help

For help evaluating the potential savings for your company, request a credit benefit estimate or reach out to your Moss Adams service professional.